FinCEN extends Beneficial Ownership Information Reporting Deadline to January 13, 2025

Hear It Here First FinCEN extends Beneficial Ownership Information Reporting Deadline to January 13, 2025 December 26, 2024 NPA’s GRC...

FirstCash Loses a Round to the CFPB in Texas

FirstCash Loses a Round to the CFPB in Texas The CFPB’s Enforcement Agenda Will Roll Along into 2025 November 14, 2024 It may be easy to...

What the Federal Election Outcome Means for Pawn

What the Federal Election Outcome Means for Pawn November 7, 2024 The Republican Party is poised to gain control of the Administration, the...

FinCEN Intends to Enforce Compliance with its Beneficial Ownership Information Rule

FinCEN Intends to Enforce Compliance with its Beneficial Ownership Information Rule October 24, 2024 Team GRC has been telling members that...

The Federal Reserve System Invites Small-Business Owners to Complete Its 2024 Small Business Credit Survey

The Federal Reserve System Invites Small-Business Owners to Complete Its 2024 Small Business Credit Survey On October 8, 2024, the Federal...

GRC Briefing on Beneficial Ownership Information Reporting

GRC Briefing on Beneficial Ownership Information Reporting October 1, 2024 A question for a long-time NPA Board of Directors member...

FinCEN: New BOI Reporting Guidance for Businesses Dissolved in 2024

FinCEN: New BOI Reporting Guidance for Businesses Dissolved in 2024 September 2024 In July 2024, FinCEN updated a piece of guidance that...

New Rule About NonBank Registration of Court Orders

TEAM GRC ALERT: Nonbank Registration of Orders Rule Goes into Effect on September 16, 2024 September 4, 2024 Earlier this summer, we wrote...

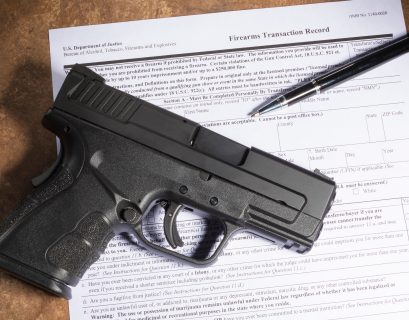

State Update on Firearm Waiting Periods and Firearm Taxes

Hear It Here First State Update on Firearm Waiting Periods and Firearm Taxes February 8, 2024 Our normal procedure is to alert the...

Firearm Merchant Code Bills Across the Country

Hear It Here First Firearm Merchant Code Bills Across the Country 2/1/24 Merchant codes are four-digit codes that categorize retailers...

State Legislatures Launch Bills to Prohibit Use of “Social Credit Scores” by Financial Services Providers

Hear It Here First State Legislatures Launch Bills to Prohibit Use of “Social Credit Scores” by Financial Services Providers January...

A New Round of Bank Discontinuance May Be Starting

Hear It Here First A New Round of Bank Discontinuance May Be Starting January 11, 2024 In the past few days, the NPA’s GRC Liaison has...

Senators Introduce 36% APR Legislation for All Consumers

On Friday, December 15, 2023, Senator Jack Reed (D. Rhode Island) introduced the Predatory Lending …

Harmful data broker practices affecting Americans’ privacy

Harmful data broker practices affecting Americans’ privacy August 18, 2023 On Tuesday, August 15, the White House held a roundtable...

If Your Business’ Wireless Provider Demands You Register with a Wireless User Registry, You Should Read This!

If Your Business’ Wireless Provider Demands You Register with a Wireless User Registry, You Should Read This! August 9, 2023 Your...